The effects of the COVID-19 pandemic became very real during the year. This was something we had anticipated, and we were able to be there for our clients during this difficult time. The pandemic demonstrated the value of insurance in that it was a completely unexpected event and a reminder that life doesn't always follow a predictable course," says Liberty Chief Executive for Retail Solutions David Jewell.

In 2021 Liberty paid out a total of R10.12 billion in claims under its flagship Lifestyle Protector policy to 43 600 individual clients and their beneficiaries.

These payments represent a 59.6% increase from the previous year, 2020, when Liberty paid out R6.43 billion in claims. The substantial rise was due to the cumulative effects of the two most damaging waves of COVID-19, the Beta wave in late 2020 and the Delta wave in mid-2021; coupled with all the other existing risk events that clients are ordinarily exposed to outside of the virus.

"The effects of the COVID-19 pandemic became very real during the year. This was something we had anticipated, and we were able to be there for our clients during this difficult time. The pandemic demonstrated the value of insurance in that it was a completely unexpected event and a reminder that life doesn't always follow a predictable course," says Liberty Chief Executive for Retail Solutions David Jewell.

In total, COVID-19 related claims amounted to R3.47 billion, paid out to clients and their families who were affected by the pandemic. Over 61% of these claims were related to Life Cover for mortality events.

These included funeral claims as people grieved their loved ones.

| Total | Proportion |

| Covid-19 | 21.2% |

| Cancer | 20.7% |

| Cardiovascular disorder | 17.4% |

| Respiratory disorder | 9.4% |

| Stroke | 4.4% |

| Top 5 causes | 73.1% |

| All other causes | 26.9% |

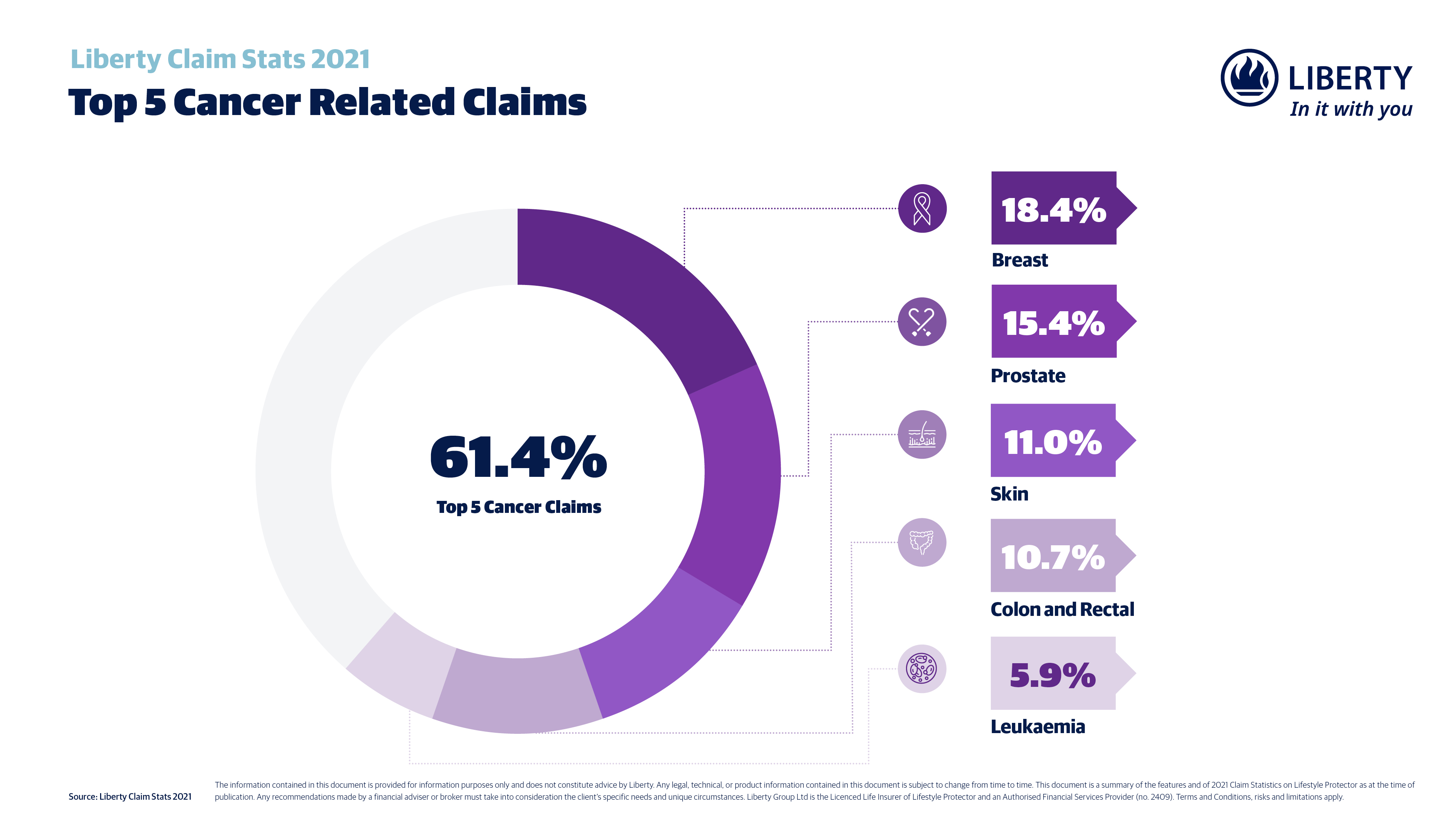

Cancer and cardiovascular claims

While COVID-19 claims made up 21.2% of all claims in 2021, cancer remained a significant disease as well, making up for 20.7% of all claims during this time.

For men, prostate cancer was the most common, making up almost 29% of all male cancer claims. While for women, breast cancer was the most common, making up 38% of all female cancer claims.

After cancer, various heart related conditions also took their toll, making up 17.4% of all disease claims.

"Cancer and many heart conditions can in part be understood as lifestyle related conditions, and this reflects on the health challenges faced by many South Africans," says Liberty's Chief Medical Officer, Dr Dominque Stott.

| Total | Proportion |

| Breast | 18.4% |

| Prostate | 15.4% |

| Skin | 11.0% |

| Colon and Rectal | 10.7% |

| Leukaemia | 5.9% |

| Top 5 causes | 61.4% |

| All other causes | 38.6% |

| Female | Proportion |

| Breast | 38.0% |

| Skin | 10.2% |

| Colon and Rectal | 7.5% |

| Leukaemia | 4.9% |

| Lung | 4.5% |

| Top 5 causes | 65.1% |

| All other causes | 34.9% |

| Male | Proportion |

| Prostate | 28.4% |

| Colon and Rectal | 13.4% |

| Skin | 11.8% |

| Lymphoma | 6.9% |

| Lung | 4.9% |

| Top 5 causes | 65.4% |

| All other causes | 34.5% |

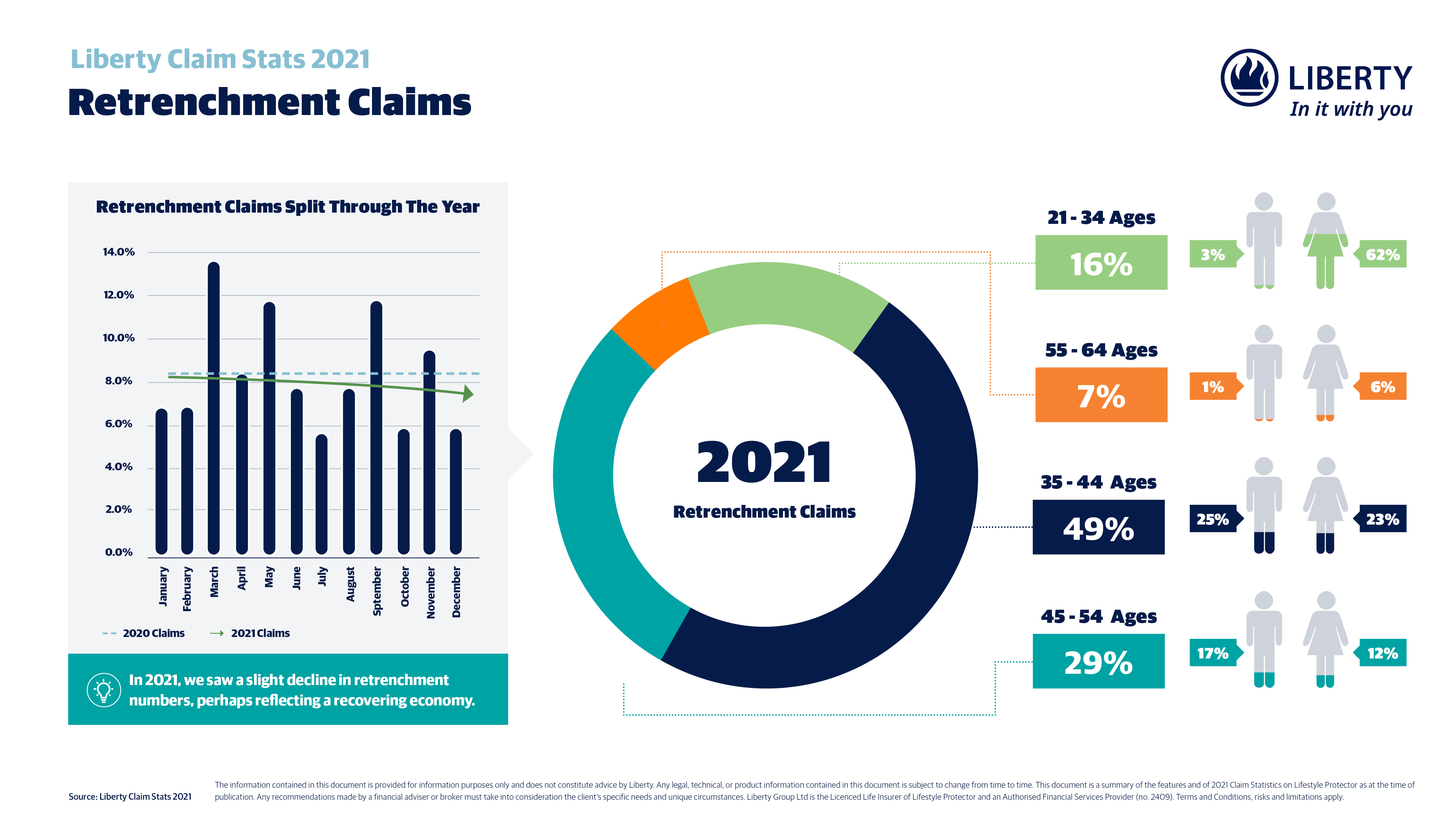

Retrenchment

In 2021 retrenchment numbers started stabilizing, staying mostly constant throughout the year. The numbers were not as high as in 2020, yet retrenchment remains higher than the pre-pandemic numbers seen in 2019, as many ordinary people battle tough economic conditions.

"Unemployment in South Africa continues to be high and this weighs heavily on many South Africans, but the rate of increase has reduced from what was seen in 2020 during the early lockdown stages," says Jewell.

Retrenchment claims in 2021 formed 7.2% of all Lifestyle Protector claims, compared to 8% in 2020.

| Description | Female | Male | Total |

| Retrenchment 2021 | 3.7% | 3.5% | 7.2% |

| Retrenchment 2020 | 3.2% | 3.8% | 8.0% |

| Description | Female | Male | Total |

| 21 - 34 | 62% | 3% | 16% |

| 35 - 44 | 23% | 25% | 49% |

| 45 - 54 | 12% | 17% | 29% |

| 55 - 64 | 6% | 1% | 7% |

| Grand Total | 53% | 47% | 100% |

Individual Liberty insurance product payouts:

| Life Protection | R8 734 222 000 |

| Lifestyle Protection | R799 905 000 |

| Income Protection (lump sum) | R345 885 000 |

| Income Protection (monthly) | R240 683 000 |

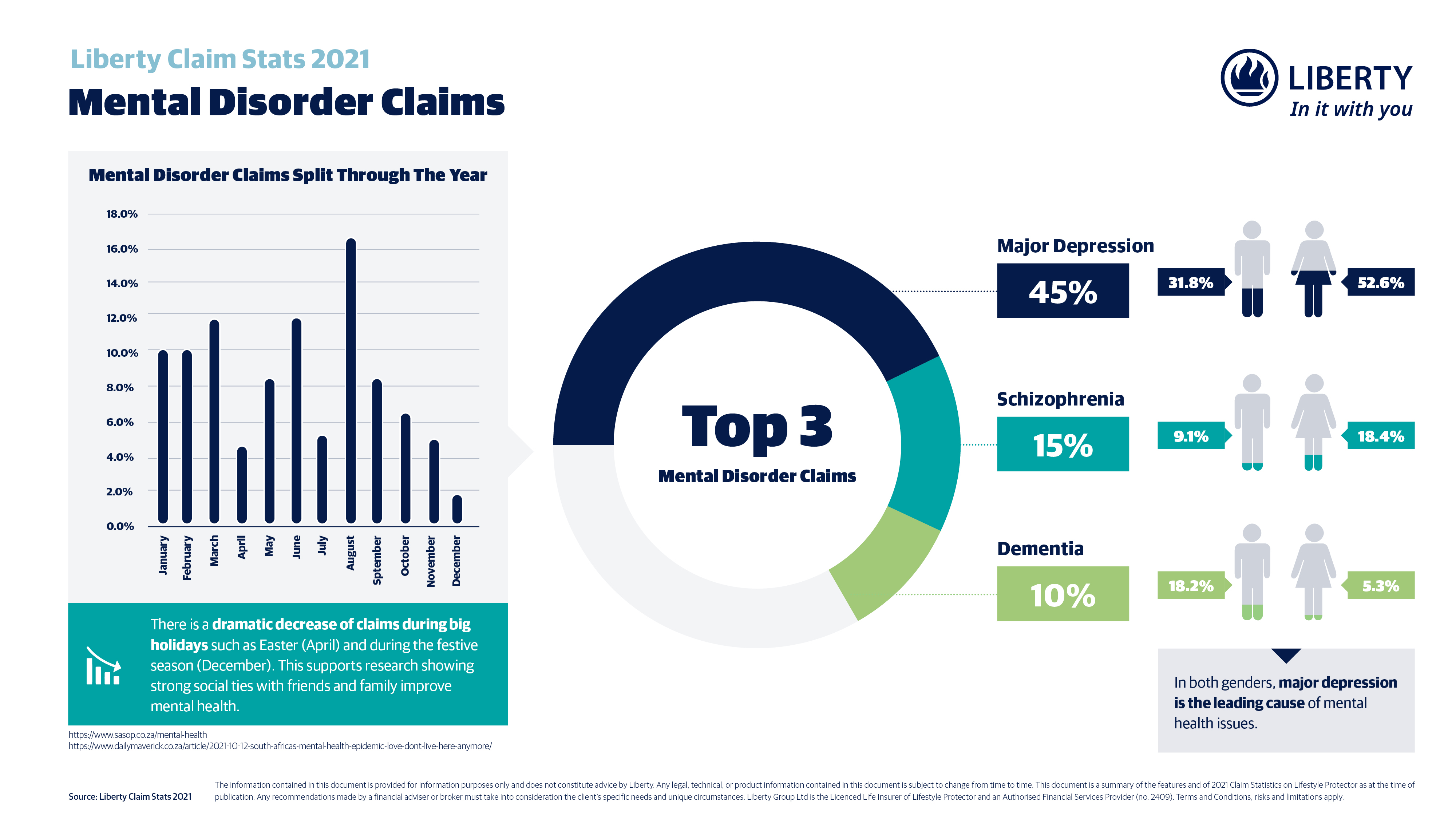

Mental health claims

Liberty saw a spike in mental health claims from its clients during 2021, particularly among working people between 35 and 54 years. This has been largely attributed to the stresses brought on by COVID-19.

To assist them, Liberty paid out numerous claims for conditions like major depression which accounted for 45% of all mental health claims, and for schizophrenia which accounted for 15% of all mental health claims.

Other causes of mental health claims were for conditions like anxiety, the inability to work and grief.

"The stresses brought about by the pandemic have brought about long-term effects, including a mental health crisis because understandably people lost loved ones, were retrenched, and are struggling to get by because of the economic upheaval," says Dr Stott.

| Mental disorder | Distribution |

| Major depression | 45.0% |

| Schizophrenia | 15.0% |

| Dementia | 10.0% |

| Age band | Percentage claims |

| < 20 | 3.3% |

| 21 - 34 | 1.7% |

| 35 - 44 | 33.3% |

| 45 - 54 | 35.0% |

| 55 - 64 | 25.0% |

| > 65 | 5.0% |

Liberty corporate claims

For Liberty Corporate, the claims pay out was R3.43 billion. This is 40% higher than 2020. The main cause of the increase was Group Life Assurance claims which increased by 84%. COVID-19 made up 8% of all claims.

Below is a summary for the 2021 corporate claims:

| Death Benefits | Group Life Assurance - R2 215 000 000 Family funeral Benefit - R137 000 000 |

| Disability benefits | Lump sum disability - R93 000 000 Income Protection - R758 000 000 |

| Critical illness | Living Assurance - R77 000 000 |

| Credit Life | Credit Life - R154 000 000 |

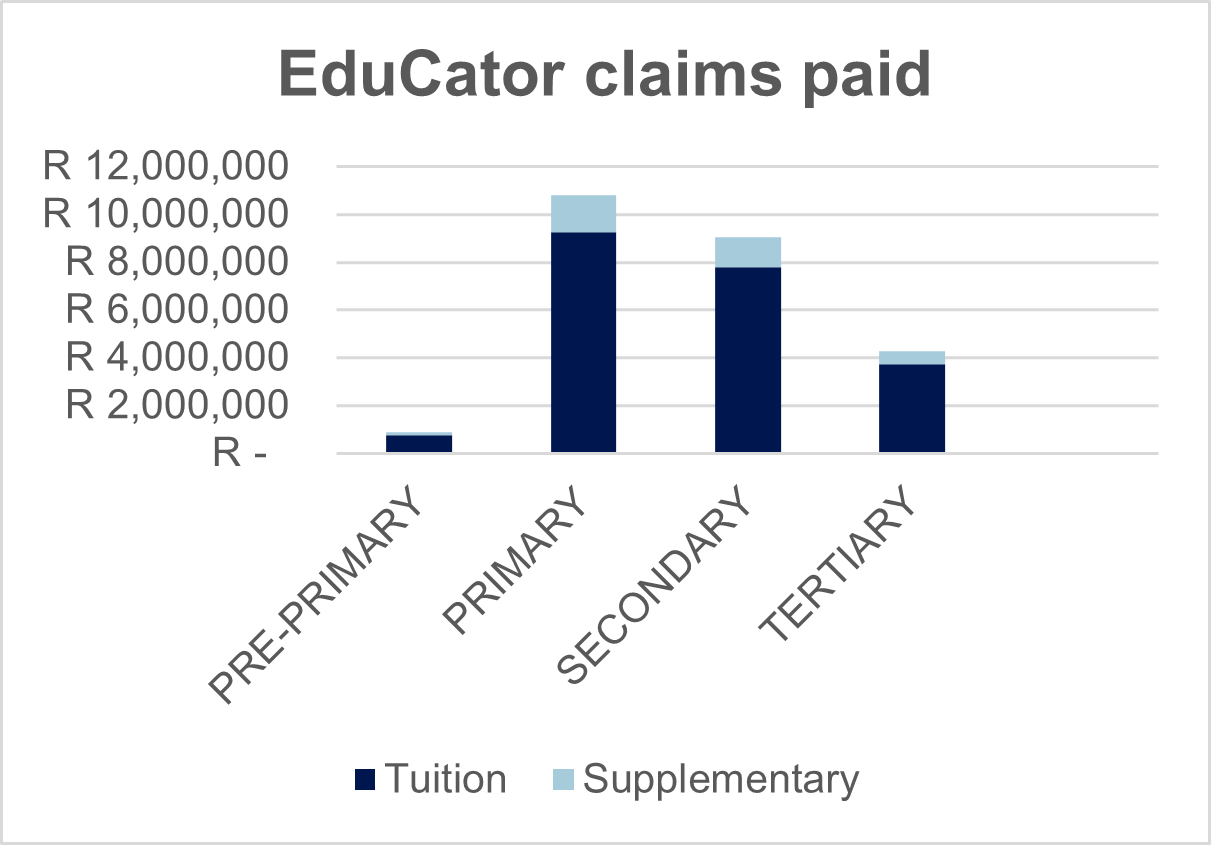

Education

The Educator benefit ensured that almost 600 children were able to stay in school in 2021 following their parents or caregivers passing away or being unable to work due to a disability or being diagnosed with a specified critical illness. At least R25 million in claims was paid out through this benefit last year. Added to that, 14% of all claim amounts paid covered supplementary allowances, ensuring that there was provision for other expenses like textbooks, uniforms, and transport to school.

Giving back to clients

Liberty paid R114 million in ADDLIB Bonus pay-outs, a benefit to qualifying clients that receive a cash-back on their premiums under the Lifestyle Protector product suite. This pay-out gave clients the protection and provision they needed in a year where the economic impact of the pandemic was hard felt. Since its inception in 2012, the programme has paid over R714 million in bonuses.

Full Disclosure

Liberty paid out 93.6% of all claims received from clients during the year, offering relief in a time of vulnerability. Claims not paid were as a result of factors like unmet policy or benefit criteria, and non-disclosure.

Lisa Gibbon, Divisional Executive for Onboarding at Liberty says, "the importance of full-disclosure should be a priority conversation that all insurers should be having with their clients and advisers as often as possible. Not only will it help to reduce the occurrence of non-disclosure identified at claim stage, but it will also ensure that clients receive their pay-out when they need it most.

"At Liberty, we've placed a strong emphasis on ensuring that advisers and clients focus on providing true and accurate information during the underwriting process. We've also been encouraging advisers and clients to continuously keep us informed of any life changing medical and lifestyle changes that would impact their policies."

What is non-disclosure?

When medical, financial, lifestyle or occupational questions are answered incorrectly or when important information is omitted during underwriting, this is called non-disclosure. If your financial adviser fills in the insurance application form for you, it is your responsibility to read through everything carefully before signing.

ENDS.

DISCLAIMER

This article does not constitute tax, legal, financial, regulatory, accounting, technical or other advice. The material has been created for information purpose only and does not contain any personal recommendations. While every care has been taken in preparing this material, no member of Liberty gives any representation, warranty or undertaking and accepts no responsibility or liability as to the accuracy, or completeness, of the information presented.

Liberty Group Ltd is the licensed Life Insurer of Lifestyle Protector and an Authorised Financial Services Provider (no. 2409). Terms and Conditions, risks and limitations apply.

*Natural causes include the most likely specific causes such as cancer and leukaemia. Natural causes are classified based on the descriptions provided from death certificates and therefore Liberty relies on this as an indicator for all death related claims, including claims related to COVID-19. Due to under-reporting and a lack of substantive testing in the medical field (lack of lab facilities, testing methodologies used at unaccredited labs, etc) figures for COVID in South Africa are understood to be under-reported.